Va irrrl closing costs calculator

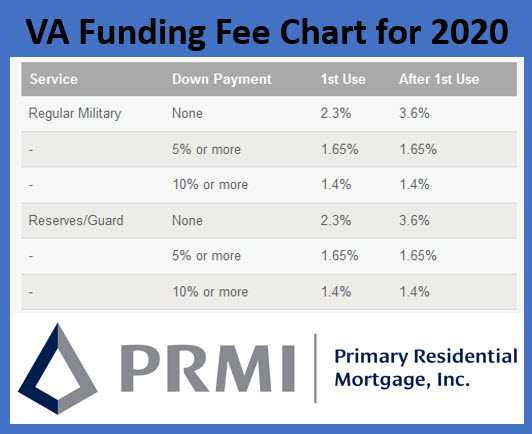

VA loans are mortgages granted to veterans service members on active duty members of national guards reservists or surviving spouses. When you are buying a house this funding fee currently ranges between 14 and.

Va Loan Closing Costs Complete List Of Fees To Expect

VA IRRRL Payment Calculator.

. Ad Dont waste your VA loan benefits. As of January 1 2020 the VA funding. Compare 2022s Top VA Mortgage Lenders.

How much does the VA Funding Fee Cost. The first use funding fee is 23 on the amount borrowed with your VA home loan. Lets say youre using a VA-backed loan for the first time and youre buying a 200000 home and paying a down payment of 10000 5 of the 200000 loan.

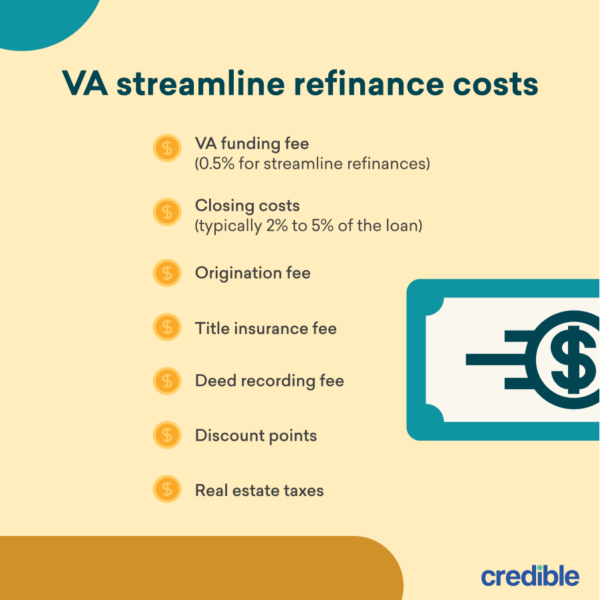

The fee is a percentage of the loan amount that varies from 0 to 36. For your reference here is the relevant portion in the VA Lenders Handbook about closing costs on an IRRRL. That means for a 300000 mortgage VA closing costs could be anywhere from 3000 to.

Get Instantly Matched With Your Ideal VA Home Loan Lender. Call us to take advantage of them. The following fees and charges may be included in an IRRRL.

The loan or paid at closing. The costs can include the funding fee lender fees discount points and payments for taxes and insurance. That means for a 300000 mortgage VA closing costs could be anywhere from 3000 to.

Ad Find The Best Options for Veterans Buying a Home. If the IRRRL reduces the loan term or converts an. The fee goes directly to the VA loan program not the lender.

Call us to take advantage of them. The closing costs of VA refinances are often between 1 and 3 of the loan amount. Skip the Bank Save.

VA loan closing costs for a home purchase can be between 1 and 5 of the total loan amount. If the calculation on line C exceeds 36 months VAs Interim QM rule requires credit qualification of the IRRRL. Compare Start Saving.

The fee changes to 36 on any future VA. Most veterans and service members will have to pay a one-time VA funding fee when they get a VA loan. Closing costs are typically 2 to 4 of the loan amount.

About one-third of all VA loan borrowers are exempt so ask a VA loan lender if you qualify for an exemption. Follow your lenders process for closing on the IRRRL loan and pay your closing costs. Enjoy Zero Down Payment Low Rates.

You may need to pay the VA funding fee. Since the monthly PI for recoupment purposes of the new IRRRL is 85106 this loan would not meet the recoupment requirement. This calculator is for general education purposes only and is not an illustration of current Navy Federal products and offers.

If however the lender uses the current rate. Ad Use Our Comparison Site Find Out Which Lender Suits You Best. This one-time fee helps to lower the cost of the.

VA IRRRL Interest Rate Reduction Refinance Loan is a streamlined VA refinance allowing those with VA loans to refinance to a new VA loan with. Ad Dont waste your VA loan benefits. For example if the costs.

Va irrrl closing costs calculator Senin 05 September 2022 Edit. For your reference here is the relevant portion in the VA Lenders Handbook about closing costs on an IRRRL.

Delaware Va Loans For Veterans Prmi Delaware

Va Irrrl Rates Online 51 Off Ilikepinga Com

Va Loan Funding Fee Closing Cost Calculator

Va Loan Calculator Estimates Your Mortgage Payment Casaplorer

Va Streamline Refinance Va Irrrl How It Works And When To Get One Credible

Minimum Credit Score For Va Irrrl 2022 Information

What Are The Irrrl Allowable Fees Irrrl

Va Irrrl Refinance Streamline Va Interest Rate Reduction Loan

Va Loan Refinancing Va Irrrl Streamline Refinance Loan In Austin Texas

Va Streamline Refinance Va Irrrl How It Works And When To Get One Credible

Va Loan Funding Fee What You Ll Pay In 2022 Nerdwallet

Va Streamline Refinance Irrrl 100 Cash Out Interest Rate Reduction

Irrrl Closing Costs Irrrl Com

Va Irrrl Guidelines Seasoning And Pre Pay Penalties

How Much Will My Va Appraisal Cost Irrrl

Va Irrrl Worksheet What Is It And How Do I Use It

Va Loan Funding Fee Closing Cost Calculator